Generations & Age

Transamerica Institute and its Transamerica Center for Retirement Studies (TCRS) conducts extensive research on generations and age in retirement security.

The following research reports are available below:

Post-Pandemic Realities: The Retirement Outlook of the Multigenerational Workforce

|

July 6, 2023

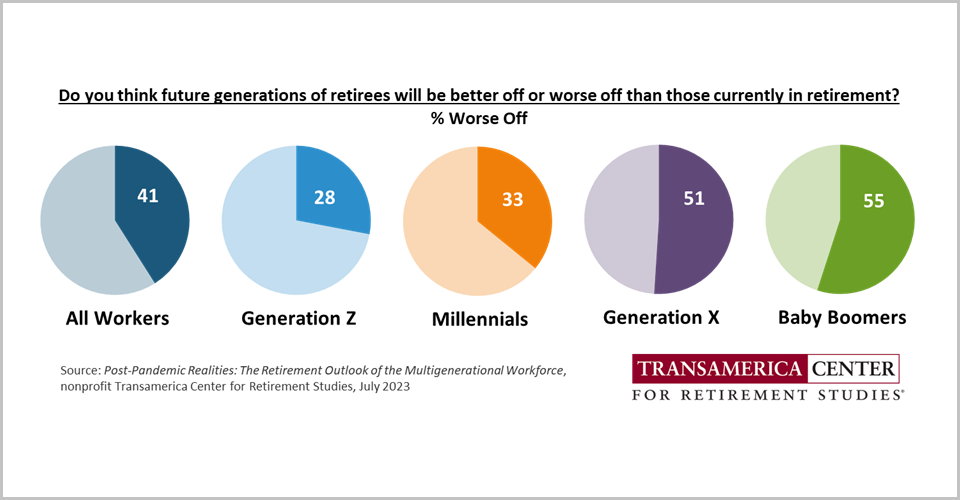

Today’s multigenerational workforce is contending with the persisting post-pandemic hangover and hurdles to their future retirement. Based on the 23rd Annual Retirement Survey, this report examines the employment, finances, health and well-being, and retirement planning of Generation Z, Millennials, Generation X, and Baby Boomers. It outlines the shifting retirement landscape and recommendations for workers, employers, and policymakers.

|

Research Report

Download

Press Release

Download

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|

Emerging From the COVID-19 Pandemic: Four Generations Prepare for Retirement

|

October 12, 2022

Workers across generations -- Baby Boomers, Generation X, Millennials, and Generation Z -- are envisioning and saving for an active and purposeful retirement amid an uncertain future. Based on the 22nd Annual Retirement Survey, this report focuses on the experiences of employed workers of for-profit companies and the impacts of the pandemic on their health and happiness, employment, financial well-being, and preparations for retirement. It also offers recommendations for workers, employers, and policymakers to improve retirement security.

|

Research Report

Download

Press Release

Download

Podcast

Listen

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|

Living in the COVID-19 Pandemic: The Health, Finances, and Retirement Prospects of Four Generations

|

August 5, 2021

Workers across generations are living through a public health crisis that has disrupted their daily lives from health and family to employment and finances. Yet, workers across four generations are saving for retirement despite pandemic-related financial strain. Based on the 21st Annual Retirement Survey, this report examines the experiences four generations – Generation Z, Millennials, Generation X, and Baby Boomers – and the impacts of the pandemic on their health, employment, financial well-being, and their ability to save and invest for retirement. It also offers recommendations for workers, employers, and policymakers to improve retirement security.

|

Research Report

Download

Press Release

Download

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|

20th Compendium of Findings About the Retirement Outlook of U.S. Workers

|

December 18, 2020

The 20th Compendium of Findings About the Retirement Outlook of U.S. Workers provides in-depth demographic analyses and insights on workers' retirement planning-related activities, access to employer-sponsored retirement benefits, prevalence of debt among workers, retirement savings rates, and how workers have been impacted by the coronavirus pandemic. Based on surveys conducted in late 2019 and October 2020, as part of the 20th Annual Retirement Survey, it offers 25+ key indicators of retirement readiness by employment status (full-time vs. part-time), urbanicity, LGBTQ status, level of educational attainment, generation, gender, and race/ethnicity.

Chapters - Influences of Demographics on Retirement Readiness

- U.S. Workers and Employment Status - pg. 12

- Urbanicity - pg. 45

- LGBTQ Status - pg. 77

- Educational Attainment - pg. 109

- Generations - pg. 141

- Race/Ethnicity - pg. 206

|

Research Report

Download

Press Release

Download

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|

Retirement Security Amid COVID-19: The Outlook of Three Generations

|

May 19, 2020

Workers across generations are at risk of not achieving a financially secure retirement — an issue of major concern long before the coronavirus pandemic. Now, the negative economic effects of the pandemic are further threatening generations’ retirement security and dreams. Based on surveys conducted in late 2019 and April 2020, as part of the 20th Annual Retirement Survey, this report examines the financial impacts of pandemic and retirement risks faced by Millennials, Generation X, and Baby Boomers before and during the pandemic. It also provides recommendations for improving workers’ retirement prospects as they navigate through these unprecedented times.

|

Research Report

Download

Press Release

Download

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|

19th Compendium of Findings About the Retirement Outlook of U.S. Workers

|

December 19, 2019

The 19th Compendium of Findings About the Retirement Outlook of U.S. Workers provides in-depth demographic analyses and insights on workers' retirement planning-related activities, access to employer-sponsored retirement benefits, prevalence of debt retirement savings rates, and how workers think their retirement will take place. Based on the 19th Annual Retirement Survey, it offers 30+ key indicators of retirement readiness by employment status (full-time/part-time), generation, gender, household income, level of education, and race/ethnicity.

Chapters - Influences of Demographics on Retirement Readiness

- U.S. Workers and Employment Status - pg. 12

- Generations - pg. 46

- Gender - pg. 80

- Educational Attainment - pg. 114

- Household Income - pg. 149

- Ethnicity - pg. 185

|

Research Report

Download

Press Release

Download

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|

What Is "Retirement"? Three Generations Prepare for Older Age

|

April 3, 2019

Retirement means "freedom" – a common thread weaving together Baby Boomers, Generation X, and Millennials in the workforce. Yet, simultaneously, people are grappling with how they will achieve financial success in older age. Based on the 19th Annual Retirement Survey, this report explores three generations’ visions of aging and what “retirement” personally means to them; their financial preparations, steps toward safeguarding their long-term health and happiness, and work-life balance. It also provides insights into the vital role of employers in helping workers prepare for older age, such as the value of offering workplace retirement benefits, employee education about the Saver's Credit and catch-up contributions, support for work-life balance and alternative work arrangements, among many other opportunities.

|

Research Report

Download

Press Release

Download

Share and Tag Us on Twitter

@TI_insights

@TCRStudies

|